Taxable income formula

Definition of Taxable Income. This list serves as a guide and is not intended to replace.

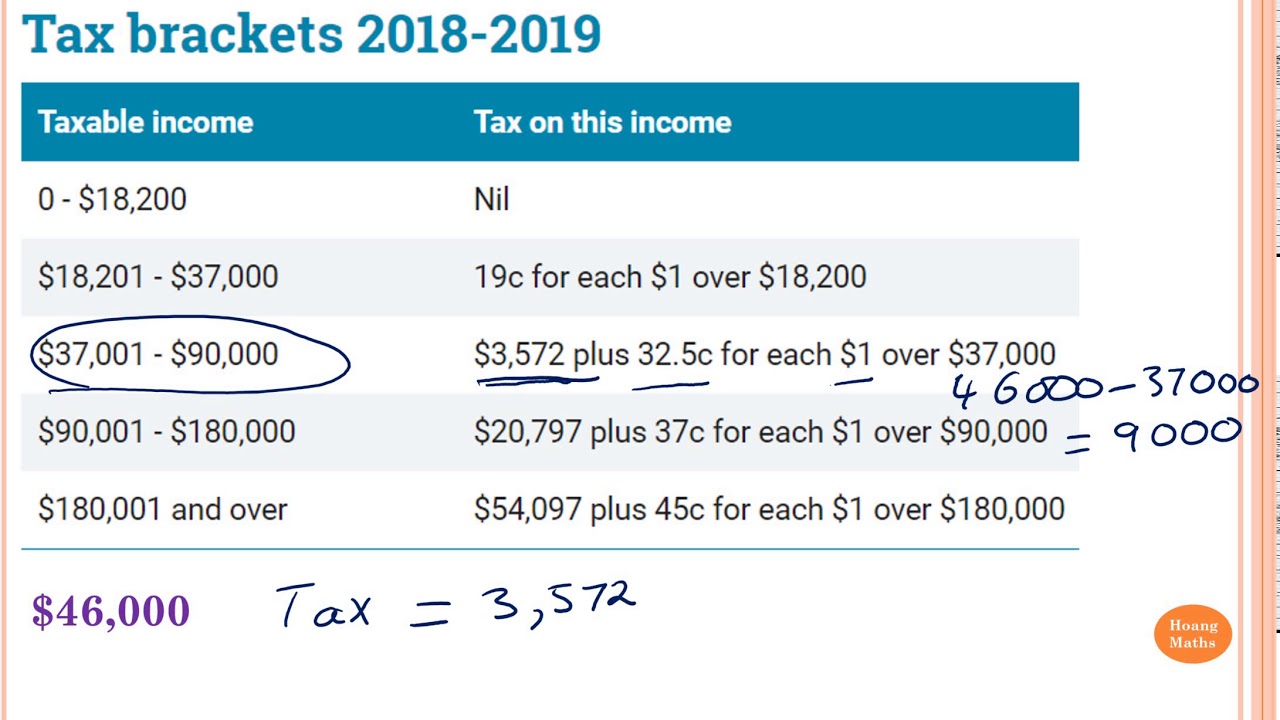

Calculating Tax Payable Part 1 Youtube

Calculate Your 2022 Tax Return 100.

. Taxable income total income gross income - exempt income - allowable deductions. Taxable income is the amount on which tax will be calculated on. Income Tax Payable for an.

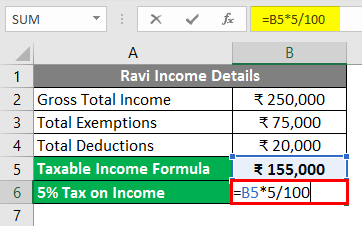

Ad TurboTax Makes It Easy To Get Your Taxes Done Right. Apply the following formula in cell B7. Therefore the taxable income becomes more than 57000 510006000 calculated with the same tax rate of 35.

Then use a simple formula from the IRS website to determine how much of the total gross monthly income should be taxed at the federal level and how much at the state. Divide the companys total tax liability by the statutory tax rate listed on the governments tax table to. Income tax is calculated for a business entity or individual over a particular period usually over the financial year.

Easily E-File to Claim Your Max Refund Guaranteed. The first 9950 is taxed at 10 995. Add up all sources of taxable income such as wages from a job income from a side hustle investment returns etc.

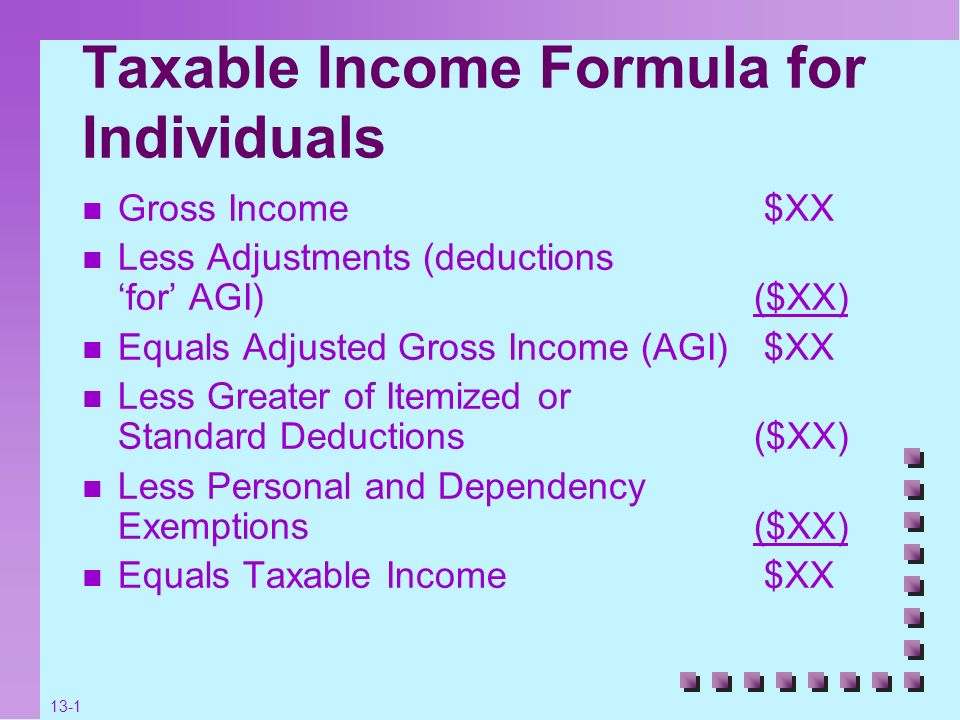

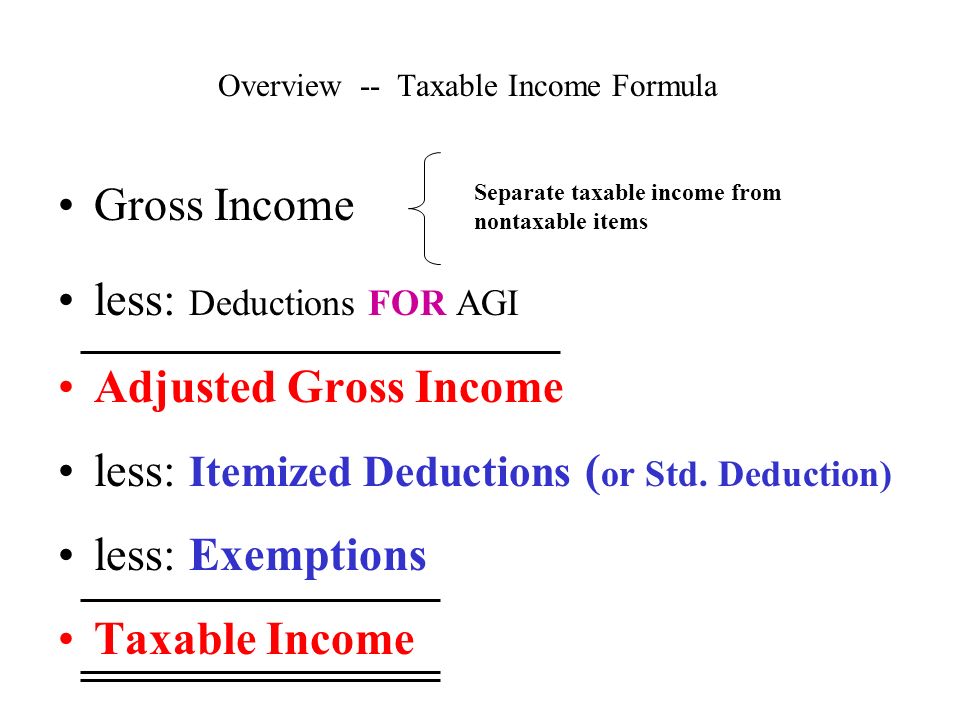

An amount of money set by the IRS that. Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP. Gross income is all income from all sources that isnt specifically tax-exempt under the Internal Revenue Code.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. As the taxable value is between 15 to 25 lakhs so that 5 will apply to income. Now calculate the tax on extracted taxable value.

Allowable deductions from gross income including certain employee personal retirement insurance and support expenses. The tax levied is governed by Indian Income Tax Act 1961The income tax received by taxpayers is the main. Taxable income starts with gross income then certain allowable.

Calculate Your Gross Income. The tax payable will be thus 19950. View a list of items included in Michigan taxable income.

To illustrate say your. No Tax Knowledge Needed. The tax levied on every individual is different depending on their income.

Using the brackets above you can calculate the tax for a single person with a taxable income of 41049. Time To Finish Up Your Taxes. The next 30575 is taxed.

Taxable income is all income subject to Michigan individual income tax. This formula is simply the tax rate multiplied by the taxable income of the. Import Your Tax Forms And File With Confidence.

The first step in computing your AGI is to determine your total gross income for the year which includes your salary in addition to any earnings from self. Taxable income only represents the taxable portion of a companys profits. Ad Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly.

Taxable Income Formula For Individuals Ppt Video Online Download

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Taxable Income Formula Calculator Examples With Excel Template

Taxable Income What Is Taxable Income Tax Foundation

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Calculator Examples With Excel Template

Chapter 3 Calculate Taxable Income Personal And Dependency Exemptions Ppt Video Online Download

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Calculator Examples With Excel Template

Taxable Income Formula Calculator Examples With Excel Template

Income Tax Formula Excel University

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Examples How To Calculate Taxable Income

California Tax Expenditure Proposals Income Tax Introduction